Why Choosing a Mortgage Broker San Francisco Will Save You Time and Money

Why Choosing a Mortgage Broker San Francisco Will Save You Time and Money

Blog Article

Discover the Value of Employing an Expert Home Loan Broker for Your Home Purchase

Knowledge in Home Loan Choices

Navigating the complicated landscape of home loan choices needs not only knowledge but also a nuanced understanding of the financial market. A specialist home mortgage broker brings crucial expertise that can significantly boost the home-buying experience. These specialists are fluent in the myriad kinds of home loan products readily available, consisting of fixed-rate, adjustable-rate, and specialized fundings like FHA or VA home loans. Their extensive understanding allows them to recognize the very best services tailored to specific monetary situations.

Moreover, home loan brokers stay upgraded on prevailing market fads and rates of interest, enabling them to give educated recommendations. They can examine clients' monetary profiles and help in determining qualification, calculating prospective monthly repayments, and comparing total expenses linked with various home mortgage products. This level of understanding can be important, specifically for first-time property buyers that may really feel overloaded by the options offered.

Additionally, a home loan broker can assist customers browse the intricacies of funding terms, costs, and possible pitfalls, guaranteeing that debtors make educated choices. By leveraging their knowledge, property buyers improve their chances of protecting desirable mortgage conditions, ultimately resulting in a much more monetarily audio and effective home acquisition.

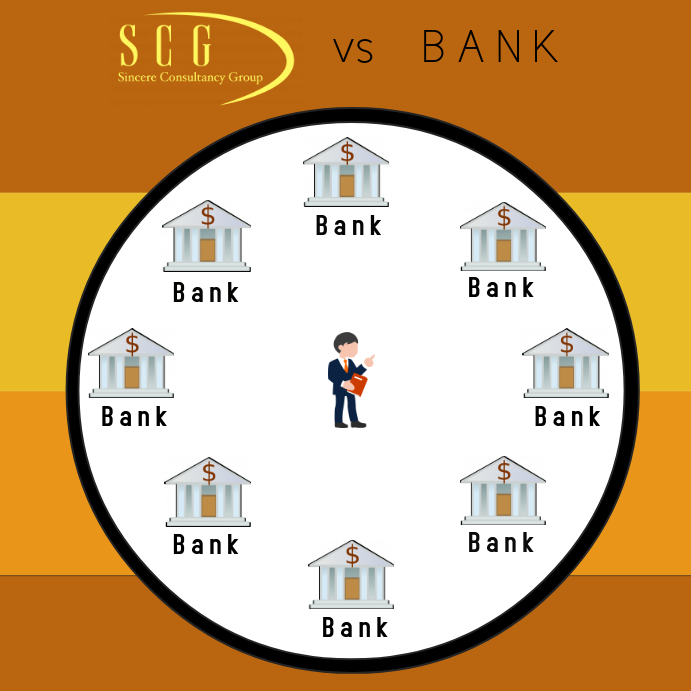

Accessibility to Several Lenders

Access to several loan providers is among the essential advantages of collaborating with a professional mortgage broker. Unlike specific consumers that might only consider a limited variety of borrowing choices, home loan brokers have established partnerships with a vast variety of loan providers, including financial institutions, lending institution, and alternate financing resources. This substantial network enables brokers to access a diverse series of finance products and rates of interest tailored to the specific demands of their clients.

By presenting numerous financing options, home mortgage brokers empower borrowers to make enlightened decisions. They can contrast different terms, rates of interest, and payment strategies, making sure that clients locate the most effective suitable for their monetary situation. This is especially advantageous in a rising and fall market where conditions can differ considerably from one lending institution to one more.

Moreover, brokers typically have insights into unique programs and incentives that might not be widely promoted. This can bring about potential financial savings and better finance conditions for debtors, ultimately making the home buying procedure more affordable and reliable. In recap, access to several lending institutions through an expert home mortgage broker boosts the borrowing experience by offering a bigger selection of financing choices and cultivating informed decision-making.

Personalized Financial Assistance

An expert home loan broker provides customized monetary advice that is tailored to the private requirements and circumstances of each debtor. By examining a client's monetary situation, consisting of income, credit report, and long-lasting goals, a broker can offer understandings and recommendations that line up with the debtor's one-of-a-kind account. This bespoke approach ensures that clients are not just presented with common alternatives, yet instead with customized home loan options that fit their certain demands.

Additionally, brokers possess extensive knowledge of various lending products and existing market fads, allowing them to inform clients about the benefits and negative aspects of various financing options. This advice is critical for consumers that may feel overwhelmed by the intricacy of home loan options.

Along with browsing with different lending standards, a home mortgage broker can assist clients recognize the ramifications of different loan terms, prices, and connected costs - mortgage broker san Francisco. This quality is crucial in equipping debtors to make educated choices that can substantially impact their economic future. Eventually, tailored monetary guidance from a home mortgage broker fosters self-confidence and comfort, ensuring that customers really feel supported throughout the home-buying procedure

Time and Expense Financial Savings

In addition to giving customized economic assistance, a specialist home loan broker can dramatically save customers both time and cash throughout the home loan procedure. Navigating the complexities of home mortgage options can be overwhelming, specifically for novice buyers. An experienced broker simplifies this process by leveraging their market expertise and links to identify the most effective home mortgage products offered.

In terms of cost savings, home mortgage brokers usually have accessibility to special funding programs and lower rates of interest that might not be available to the public. Their arrangement skills can lead to far better terms, inevitably saving customers thousands over the life of the financing. Furthermore, brokers can help customers prevent costly blunders, such as selecting the wrong home mortgage type or forgeting concealed fees. On the whole, utilizing a professional home mortgage broker is a prudent financial investment that equates to substantial time and monetary benefits for property buyers.

Anxiety Decrease During Refine

Just how can homebuyers browse the often difficult trip of obtaining a home loan with better ease? Involving a specialist mortgage broker can substantially relieve this anxiety. These specialists recognize the complexities of the home loan landscape and can assist customers through each stage of the process, making sure that they continue to be positive and informed in why not try this out their decisions.

A home loan broker works as an intermediary, streamlining interaction between buyers and loan providers. They manage the paperwork and deadlines, which can typically really feel overwhelming. By handling these obligations, brokers allow property buyers to concentrate on various other essential facets of their home acquisition, lowering total stress and anxiety.

Moreover, mortgage brokers have extensive expertise of numerous loan products and market problems. This understanding allows them to match purchasers with the most suitable alternatives, decreasing the moment invested sorting through unsuitable deals. They additionally supply individualized recommendations, assisting clients established sensible expectations and avoid usual challenges.

Eventually, employing a professional home mortgage broker not just improves the mortgage procedure however also boosts the homebuying experience. With professional support, buyers can approach this vital monetary choice with higher comfort, making certain a smoother shift into homeownership.

Verdict

In final thought, the advantages of working with a professional home mortgage broker substantially enhance the homebuying experience. Their expertise in home mortgage options, accessibility to multiple lending institutions, and capability to give individualized economic support are invaluable. In addition, the potential for time and price savings, together with stress reduction throughout the procedure, underscores the important role brokers play in assisting in educated decisions and preventing costly mistakes. Engaging a home loan broker inevitably brings about a more effective and reliable home purchase journey.

These professionals are skilled in the myriad types of home mortgage items readily available, consisting of fixed-rate, adjustable-rate, and see here now specialized loans like FHA or VA mortgages.A specialist mortgage broker provides customized financial advice that is tailored to the specific demands and scenarios of each borrower. Eventually, individualized economic guidance from a home loan broker promotes confidence and peace of mind, making sure that clients feel supported throughout the home-buying procedure.

In enhancement to supplying personalized monetary assistance, a professional mortgage broker can dramatically save clients both time and cash throughout the home mortgage process. In general, utilizing a professional home mortgage broker is a sensible investment that converts to substantial time and these details economic advantages for property buyers.

Report this page